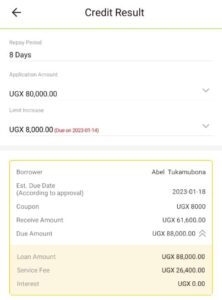

A proliferation of Micro-credit mobile apps has continued to wreck havoc on Ugandans unabated by the authorities. Numerous complaints have been logged on social media by victims of the predatory lending tendencies of these Apps that seem to have no human faces aside from the voices of the debt collectors responsible for retrieving the loans.

We shall not refer to these Apps as companies as many are unable to provide proof of registration and documentation for carrying out business.

The Bank of Uganda has previously warned people from using these Apps while UCC has warned that whereas the crimes are perpetrated using mobile devices, micro-credit is regulated by Telecom companies under Bank of Uganda.

When asked for comment on the matter by this website, UCC Executive Director Irene Kaggwa Sewankambo had this to say, “Regulators protect consumers and promote consumer interests. Its therefore critical to use licensed providers. Bank of Uganda regulates electronic payments systems under the National Payment Systems Act. Uganda Microfinance Authority handles microfinance institutions and money lenders“.

This has led to a catch 22 with no particular institution willing to take sole responsibility to deal with fraudsters.

The lending rates are against the regulations and the Apps are not registered as accredited credit institutions. The police lacks the capacity to crack down on these.

The National data protection agency had also been made aware of the data privacy concerns these Apps violate repeatedly especially user data and data of people related to those that borrow. Our data is being shared dangerously by the Apps. They have unlimited access to contacts and data resident on the phones of the victims.

Whereas it is easy to blame the victims for accepting the predatory terms and conditions of these Apps, its the role of the government to offer protection to it’s citizens. Most of these Apps are not based in Uganda, raising more concerns on regulation of the digital space in the country.

So many questions are left unanswered under these circumstances; Do they pay taxes, what about the unregulated capital flight since they are operated from outside the country? Do the different enabling services and providers such as Telecom companies not liable or complicit in this fraud? Who offers arbitration in case of disagreements?

Ugandans should not be left to fend for themselves against such sophisticated schemes. The danger is to everybody including those that are not subscribed.